Seen until recently as a miracle solution in front of the current social crisis ocurring within our human societies, blockchain seems to lose its traction power.

Like many of breakthrough innovations, blockchain could have generated too much expectations and results are slow to come, as Institut Sapiens evoked a progressive de-totemization.

Instead of blaming the technology maybe should we find the answer in pseudo-blockchains which are flooding within several organizations, willing to keep, at any cost, the control over datas contained in transactions. Grasping with full knowledge implies getting back to its basics, in other words: cryptos, such as Bitcoin.

From this inception, the essence of this technology will arise: its opened and decentralised characteristic.

“Winter is coming” in blockchain? Really?

As Forrester consulting stated, the world should expect a blockchain winter in 2019. Nothing new, in fact, because MERL already signaled in 2018 that “99% of coporate blockchain projects won't probably succeed, because 99% of projects simply don't need this technology.”

In his november opening talk at the Blockchain Paris trade show, Gilles Babinet related to the desillusionment generated by the blockchain technology: “lot of people are disappointed, there is a promise-not-kept feeling".

The era when The Economist titled that blockchain may change the world or when bitcoin skyrocketed in December 2017 with $20.000 per unit. Since the 80% value drop recorded by crypto-currencies, Bitcoin ahead, nothing seems to swing well in blockchain kingdom.

Since then, numerous experts criticize the technology and make uncompromising quick indictments: uselessness, complexity, great-consuming tech, profit bubble...

Arguably, it is hard to take things into considerations between genuine information and cognitive bias.

Without saying that during OuiShare Fest 2016, Philippe Dewost, Labchain former cofounder stated that « 80% of what we can read in the press on blockchain is bullshit ».

Nobody should dare to reconsider its nascent technology status, and therefore immature according to certain peaple, most of the time, reduced to pilot projects and proofs of concept.

Far from simply flailing at the air, they have the merit to question its sponsors on the why and how.

Taking back a Gartner report, published by the end of August 2018, Capgemini revealed that only 3% of interrogated companies have rolled out a blockchain project entered into production. For Deloitte consulting, 2019 would see an increase of the technology implement within corporate environments to reach its higher adoption level by 2023.

Moreover, extra-monetary application fields where blockchain seems particularly promising are legion, like Supply Chain, distribution, legal documents exchange, real-estate or security.

"Within a blockchain which guarantee transparency and exchanges traceability, each actor see the integrality of transactions", explains Benoit Lafontaine, CTO at Octo Technology cabinet and blockchain specialist.

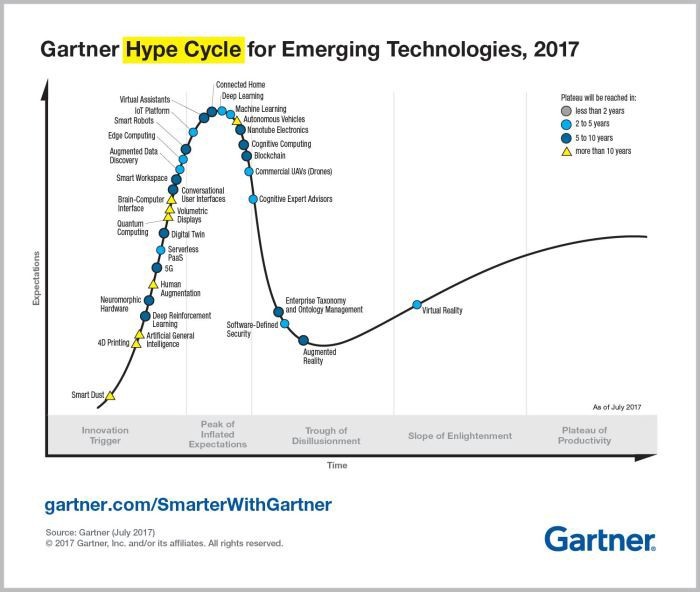

For him, blockchain is nowadays, "in its decreasing stage of the Gatner hype cycle" due to a classically initial exciting following high expectations and disproportionned promises stage.

According Gartner, the blockchain trend begin its drop stage: the plateau will be reached by 5 to 10 years.

Beyond blockchain use inflation, the crypto philosophy and its basics

Regarding the recent parlementary report led by Laure de LA RAUDIERE and Jean-Michel MIS "blockchain is a new way to set trust to convey automatic and foolproof value without intermediary."

Blockchain is a transparent data base enabling to stock and deliver informations in a securing way through cryptography to bypass traditional middle-men. It can be assimilated to a great ledger book detaining the list of the entire exchanges.

Misused at seminars, in press articles, dinners and other symposiums, blockchain already a media ubiquity gift.

Blockchain has known lot of use cases (Gartner made an inventory of 24 only this year) where the quirky meets the most promising (such as supply chain traceability, legal document transfer, even authentication of actors allowed to monitor e-advertising space purchasing). Initially born as an alternate will in front of the financial world, and intrinsically linked to crypto-currencies field and its star-money bitcoin.

First blockchain to arise in 2009, Bitcoin came from the individual suspicion towards banks following Leman Brothers bankcrupcy and clame a libertarian culture marked by transparency and desintermediation. Its founding fathers, renowned as Satoshi Nakamoto, made a tool able to break long-lasting intermediary monopoly. Bitcoin enabled to make desintermediate transactions, not ruled by a centralised control system.

Crypto-currencies, like Bitcoin, are put in circulation in a securing way, via mining activity.

Miners are users whose role is defined in the technology and are in charge of blockchain security. Divided everywhere in the world, mostly in China and Russia, those individuals take advantage the calculation power of their computer material to confirm transactions and optimize their security degree. If a miner is the first to anchor an information on a block, he is paid with bitcoin. Then, he can convert it into fiat money or exchanging it with other crypto-currencies on exchange platforms.

But, those minors who only exist within public blockchain and guarantee the probatory strength of the technology.

The pre-existing trust absence, the key reason why of the corporate blockchain adoption

It cannot be said enough often enough,blockchain enables to inject trust where there isn't yet.

As stated by journalist Grégory Raymond, specialised in blockchain and crypto-currencies: there isn't one, but several blockchains. The blockchain choice often relies on public or private option, even if the terms opened/permissioned are more suitable.

The Carrefour blockchain program manager recognises that "public blockchain are the technology's holy grail."

Adopted for bad reasons and often in a hurry, private blockchain, however, is thriving within certain firms.

For the Swiss economic magazine Bilan, Yves Bennaim has deconstructed the private blockchain myth: "if you give your home keys to a stranger who's sleeping while the door is opened, his vulnaribility is yours."

IBM and its Hyperledger solution often epitomize the private blockchain evangelization.

If the firm objective consists in owning a foolproof distributed ledger, it will be better to use alternate technologies easier and faster.

An opinion shared by Clément Jeanneau, cofounder of Blockchain Partner: "many companies kicked off, without thinking about what they wanted to do. Marketing projects really harmed the sector."

According Forrester, 2019 will see numerous initial blockchain projects turning to DLT register (Distributed Layer Technology) in order to recreate the gap with cryptos but also for the simplification of their technical approach.

Ownest has chosen a distributed ledger based on different public blockchains in order to avoid any register obsolescence. Like many blockchain early-adopter experts, we sincerely believe in public blockchain superior power. We place technology at the service of supply chain and retail professional needs in traceability.

![Cdiscount 2022 04 01 174830 mhxm]()

![Scnfbis]()

![Saint Laurent]() Company

Company